London Housing Market Report

Housing in London report

The Housing in London 2018 report is the evidence base for the Mayor’s housing policies. The report summarising key patterns and trends across a wide range of topics relevant to housing in the capital. The report has informed the development of the Mayor’s new London Housing Strategy and it can be downloaded here.

The Greater London Authority also publishes quarterly Housing Research Notes. The latest is an analysis of housing supply in London and can be found here

You can also find out more about the different sources of housing supply data that the Greater London Authority uses here.

Quarterly Housing Market report

Below is a quarterly summary of key trends in the London housing market, including prices, rents, repossessions and new housing construction. This summary draws on official statistics and other sources, and links in each case to the original source. Any queries regarding the data should in the first instance be addressed to the original source.

The summary was last updated on 21 September 2018, and is updated on a quarterly basis. While the data shown is generally the latest available, users should note that changes in the housing market can take time to show in published data

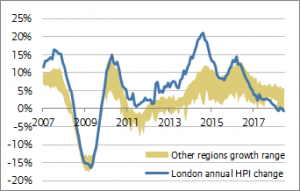

Prices

- In June 2018, the average house price in London was £475,000 (See chart, ONS, seasonally-adjusted)

- This is a decrease of 1% on one year ago, and is the lowest level of price growth in an English region over that period.

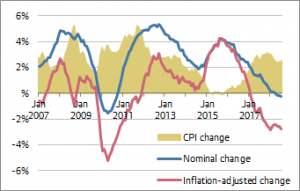

Rents

- Private rents in London fell on average by 0.3% in the year to July 2018. Private rents increased by 1.6% in the rest of England (See chart, ONS).

- London had a lower rate of growth in private rents than any other English region.

- Annual private rent increases in London have been below annual wage increases for more than a year (ONS). Private rent increases have also been below the rate of Consumer Price Inflation for over a year (ONS), as indicated by the red line in the chart.

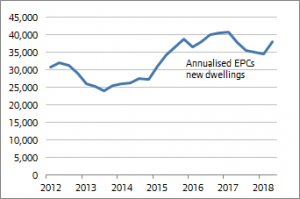

New housing completions

- 38,200 Energy Performance Certificates (EPCs) were granted in the year to June 2018 (MHCLG). This is an increase of 1% on the year to June 2017.

- EPCs are required for all new dwellings, both new build and other types such as change of use, and therefore are a good indication of how many new homes have been constructed in London.

Planning Permissions

- Figures from the Home Builders Federation (HBF) show that 63,700 homes were granted planning approval in London in 2017, 18% more than in 2016.

Mortgage Lending

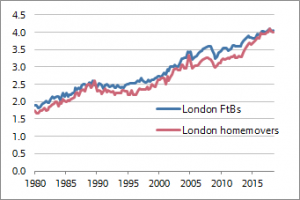

- The typical first-time buyer in London took out a loan of 4.04 times their income in Q2 2018, and the typical London home mover took out a loan of 4.01 times their income over the same period (see chart, CML).

- The Bank of England only permits 15% of lenders’ new mortgages to be at loan-to-income ratios of 4.5 or higher. This will act as a constraint on further increases in loan-to-income ratios.

- There were 41,800 new mortgages advanced to first-time buyers in London in the year to June 2018, down 1% more than in 2016/17 (CML).

Housing Transactions

- According to RICS data from their sample of London-based surveyors (weighted towards Inner London) surveyors’ stock to sales ratio has begun to peak, with signs of increased sales rates over recent months.

- However, according to RICs data, surveyors are now reporting that new buyer enquiries remain in negative territory.

Landlord and mortgage claims/repossessions